|

Traditional volume

based cost system (Direct labour hours/ Machine hours)

Do not recognize

the following:

- Additional set-up,

clean-up, scrap etc. related to more unique, complex, smaller products

Traditional ABC

maybe as good as Time driver ABC. But

- Relies on employee

estimates (lack of accuracy)

- Gives no recognition of

excess capacity (included in cost driver rates)

- Expensive to set up +

update

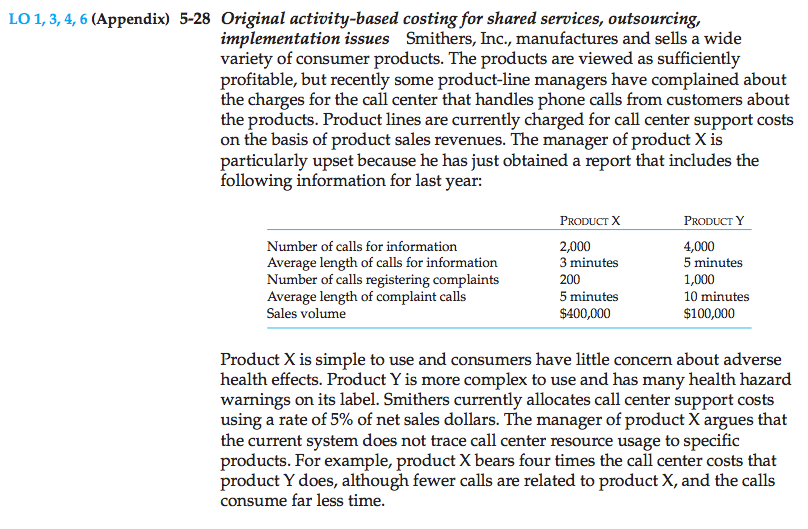

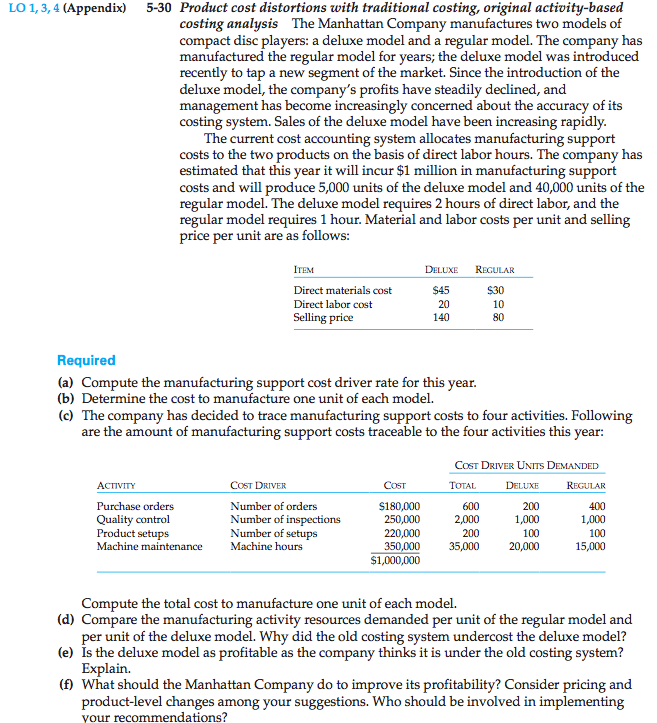

Problem 1

- Number of calls

per product (simple.

Number

of minutes of calls (duration cost driver)

- Provide better linkage to

costs

-

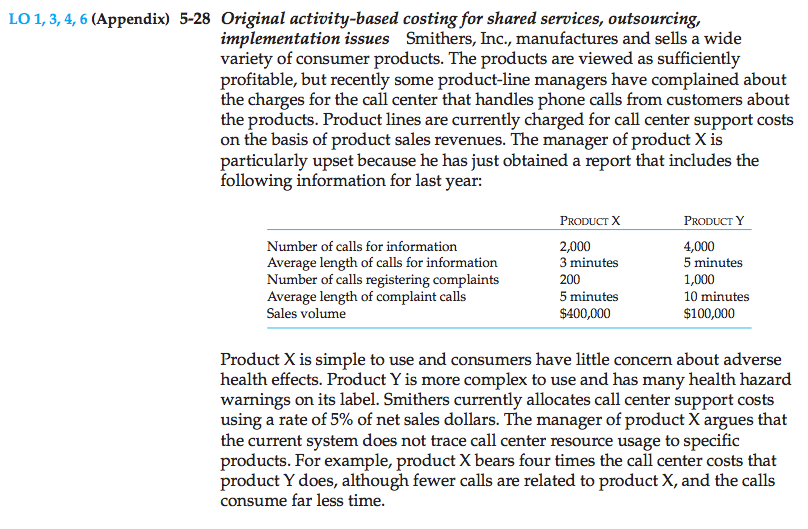

|

|

X

|

Y

|

|

Previous

(5% of sales)

|

20K

|

5K

|

|

Activity

based (.70 per minute)

|

4.9K

|

21K

|

- Previous system:

reduce allocation would be reduce sales

- This is counter productive

New

system: managers can find out methods to improve the system with other

functional areas of the company.

- People who would

resist:

- Manager of product Y

- Now we can see that most

of the resources are allocated to Y

- Stuck with more costs and

more work to minimize costs

- Fear of call

centers to be outsourced. Push call center staff to improve efficiency

and lower costs per minute.

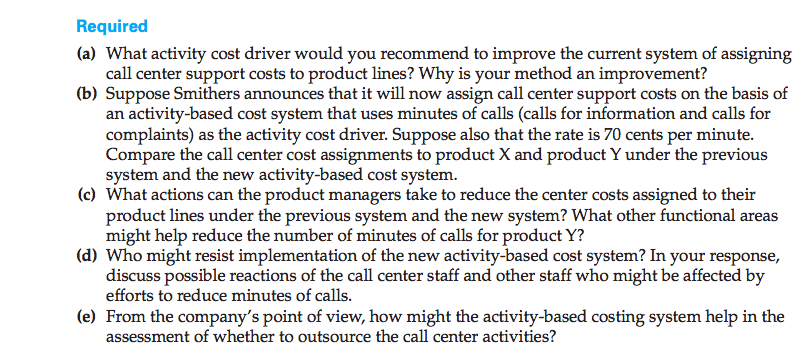

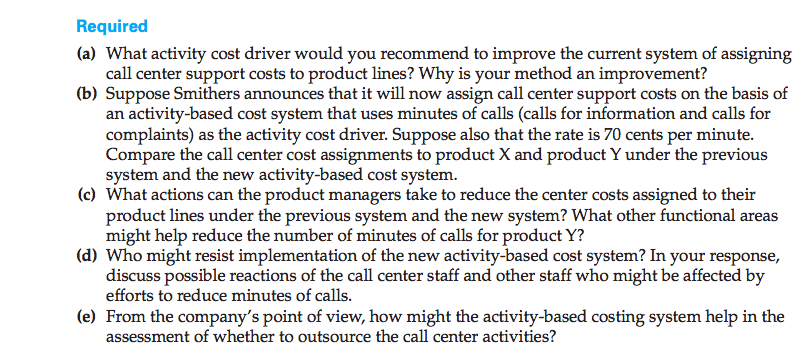

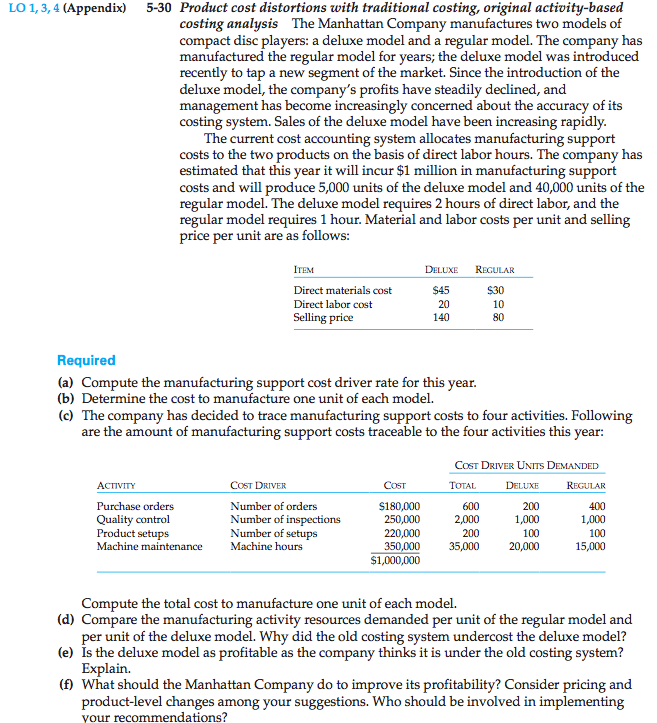

Problem 2

- M support cost

driver rate = 28.75/labour hour

|

|

X21

|

Y37

|

|

Direct Materials

Cost

|

120

|

140

|

|

Direct labour

cost

|

= 20

|

45

|

|

M support cost

|

57.5

|

85.25

|

|

Unit cost

|

197.50

|

271.25

|

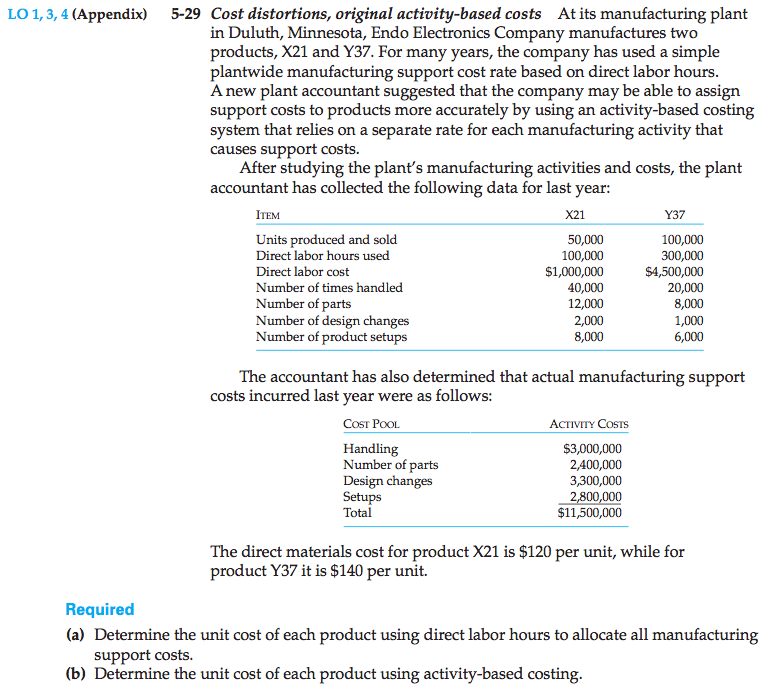

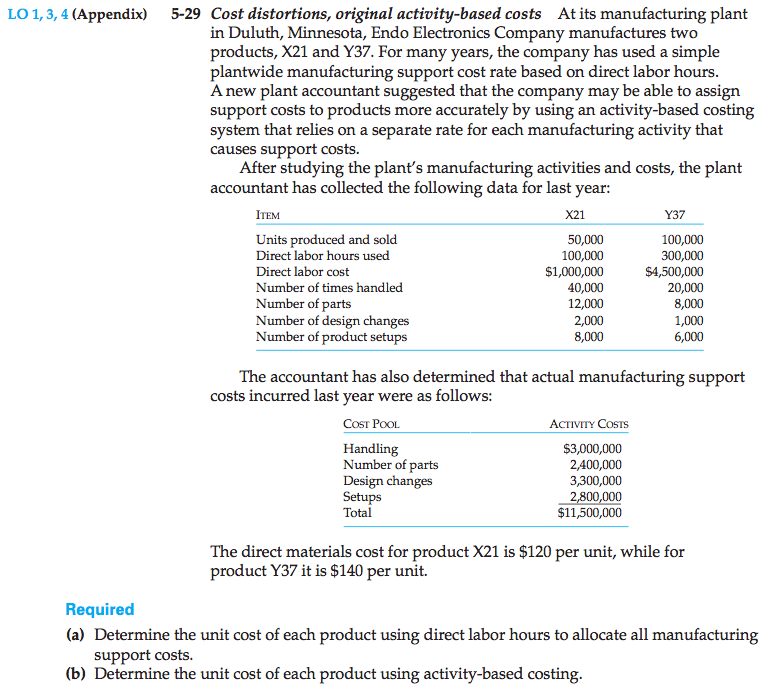

-

|

|

X21

|

Y37

|

|

Unit cost

|

284.80

|

227.60

|

- Provides a

better cost/effect relationship

- Endo should

consider raising X21's price and lowering Y37's price. Right now the

price set for X21 produces a loss based on the activity-based costing

- The company can

explore ways to reduce design changes and the number of parts for X21

since it has twice as many design changes and 50% more parts compared to

Y37.

Management

should use collective efforts to reduce costs.

Problem 3

|